If Bitcoin and Ethereum joined together to form their own country, the United Nations of Bitcoin and Ethereum would have the twelfth highest energy consumption of any countries, sitting just behind the UK and France.

That is an incredibly high level of consumption, but not altogether surprising. As of late November 2021, Bitcoin's value was equivalent to 2.9 per cent of the world’s money supply, meaning a total market value of $1.03 trillion, and Ethereum is rapidly gaining popularity.

In fact, one of the big drivers for the rise in Ethereum’s usage is NFTs. Last year, rough estimates put NFT sales at a whopping $15.7 billion in total. But why does this cause such a large energy consumption?

With Ethereum, vast amounts of processing energy are needed both to mine (create) the currency, and to confirm transactions on the blockchain (an unchangeable record of transactions).

In the current format known as proof of work, this requires computers devoting a lot of power. “The Ethereum blockchain uses a global network of computers that compete to process your data for a fee. These millions of mining computers all around the world essentially play a game of guess-the-number,” explains Dr Pete Howsen, a senior lecturer at Northumbria University.

“They guess the combination to a long string of digits, with the most powerful crypto-bingo player winning a few thousand pounds worth of cryptocurrency, as well as the fees people pay to make NFTs and store transaction records.”

This process is essentially playing the role of banks. Because cryptocurrencies aren’t on a central network, computers are needed to confirm a transaction is legitimate. But this process does come with a cost.

“Ethereum uses more energy than the Netherlands. Over 100 TWh per year. The blockchain has a carbon footprint larger than Singapore’s, around 50-60 million tonnes of CO2 per year, nearly twice as polluting as Europe’s biggest coal fired power plant (Belcatow, Poland)," Says Howsen.

“If you watched 20,000 hours of YouTube, you would generate less CO2 than if you bought or sold an NFT once. That single transaction would require the same amount of energy as your average UK household uses in two weeks.”

While these are some extreme numbers, it doesn’t mean that Ethereum is doomed to remain an energy consumption powerhouse. The company behind Ethereum has been very open about this issue, even stating themselves that the current energy expenditure is too high and unsustainable.

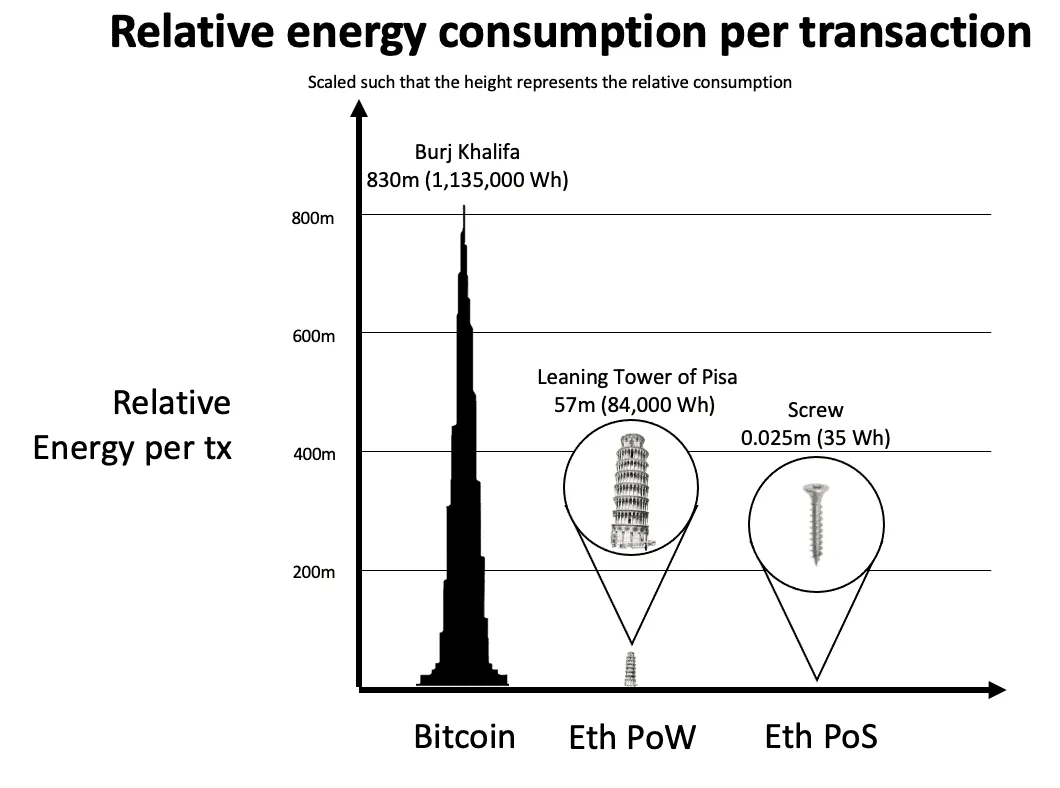

Looking to the future and how they can fix this, Ethereum is looking to move from a proof of work system to proof of stake. In essence, this simply means instead of computers guessing long strings of digits, human validators are used and they stake Ethereum as collateral to stop them becoming lazy and make sure they are authenticating correctly.

However, while this sounds like an easy change to make, it does take time. “This move from proof of work to proof of stake has been in the process for years. It’s hard to move from a legacy system to something completely new, especially when it is something as big and popular as Ethereum,” Says Merav Ozair, a leading blockchain and financial tech expert.

But once Ethereum does manage to make the move, it will result in a drastic reduction in the energy consumption used. This could mean NFTs could be produced and transferred with very little impact on the environment.

While Ethereum makes the move, there are other cryptocurrencies that are already ahead of the game on this. “Alternative’s to Ethereum already exist. These can enable NFT markets without the carbon headache because they use negligible amounts of energy on a more centralised platform. Costs are also much lower. CryptoKitties, one of the first ever NFT collections, no longer uses Ethereum. So perhaps we’re moving in the right direction.” says Howsen.

These alternative currencies (known as altcoins) started off on proof of stake systems, which allowed them to skip the environmentally damaging position both Ethereum and Bitcoin currently find themselves in.

While future cryptocurrencies are already taking a more environmental approach, and Ethereum is working towards a similar route, both Bitcoin and Ethereum mining are currently at their highest environmental impacts to date.

In mid-2021, China (one of the countries with the most miners) heavily cracked down on the mining of Bitcoin. However, recent research seems to show that this ruling increased the carbon footprint of this process, boosting the use of non-renewable energy for mining.

While Bitcoin looks to be stuck in its ways, Ethereum (and the rapidly expanding and very wealthy world of NFTs) still has the potential to adapt... it just depends on when that can happen.

The move to proof of stake was originally intended to launch with ETH 2.0 back in 2019, then a 2021 date was suggested, and now this year is expected to be the year it happens. In which case, the world of NFTs could drastically dampen their dinosaur-sized carbon footprint.

About our expert, Dr Pete Howsen

Pete is a senior lecturer at Northumbria University, focusing on environmental technologies and how new technology interacts with our environment.

Read more: